Unlock Exclusive Family Office Capital for Your Real Estate Deals

The Capital You Need—Without the Networking Headaches

If you're a Real Estate Operator or General Partner looking to scale, you know that securing capital from Family Offices can be a challenge. The right investors exist, but finding them and getting in the door is a full-time job. That’s where we come in.

At Goodfellas Business Services, we provide direct, pre-vetted introductions to Family Offices ready to invest in your deals—without endless cold outreach or wasted time. Our process is data-driven, ensuring strategic, high-quality connections—no mass cold email blasts hoping for results.

Frustrated with the Traditional Fundraising Grind?

Spent months networking, only to get ghosted by investors?

Tired of chasing capital with no clear strategy?

Fed up with cold outreach that leads nowhere?

Imagine a place where you connect directly with Family Offices looking for standout investments in your asset class. Say goodbye to lost time and being kept out. Enter a space of genuine conversation with decision-makers.

Why Work With Us?

Exclusive Access – We connect you directly with qualified Family Offices actively looking for real estate investment opportunities.

Pre-Vetted Meetings – No wasted conversations. We ensure alignment before making introductions.

Tailored Engagement Models – We offer different engagement structures depending on the client and asset class. Reach out to learn more

Streamlined Process – Get in front of decision-makers without months of networking.

Data-Driven Approach – Our introductions are based on strategic analysis and investor preferences—not random cold emails.

Who We Work With

We partner with serious real estate operators and GPs who meet key investment criteria. If you’re seeking $1M–$100M in capital and meet at least 4 out of 6 of the following requirements, we want to hear from you:

Family Office Meeting Qualification Checklist

Your project must meet at least 4 of 6 criteria:

Minimum $1M already invested by sponsor/partners

Clear revenue model with demonstrated or projected returns

Experienced management (5+ years in relevant field)

Tangible assets as collateral or investment foundation

Unique market position or competitive advantage

Scalable business model with proven comparables

Deal Structure Requirements

Seeking $1M–$100M in capital.

Offering equity, preferred returns, or a defined exit strategy

Documentation ready (pitch deck, financials, business plan)

Clean ownership structure without legal complications

Alignment with Family Office Interests

Real estate or asset-backed investment

Long-term growth potential (5+ year horizon)

Multiple revenue streams

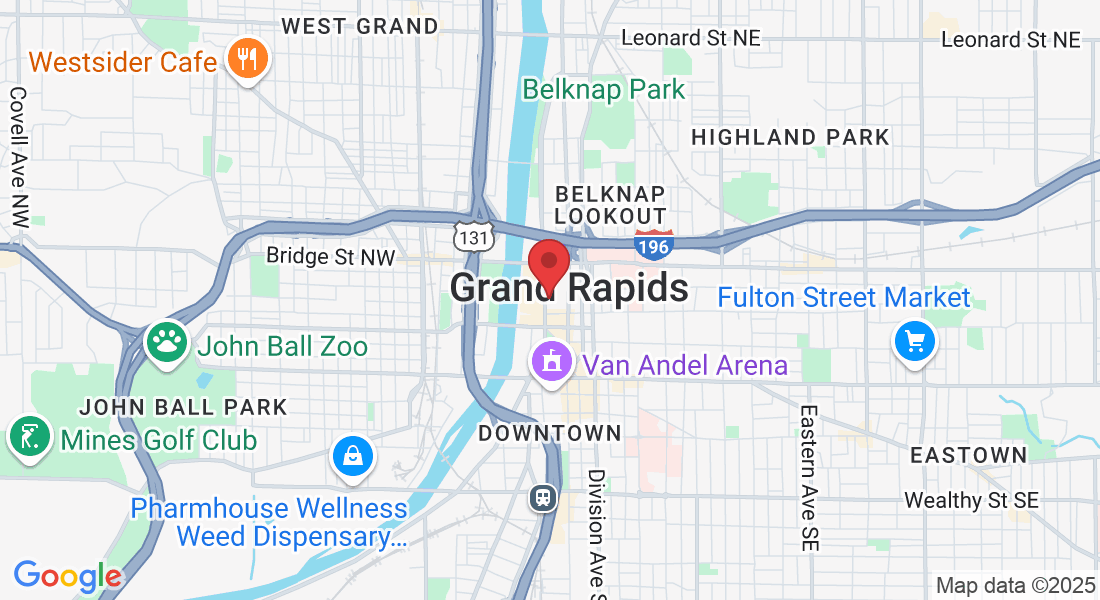

Geographic advantage or strategic location

Potential for community impact or ESG component

Success Story: $12.8M Multifamily Deal in Grand Rapids, MI

Operator: C.F. Residential

Location: Wyoming, MI

Asset Type: Class B Multifamily

Capital Raised: $10.1M from Family Offices

Time to Funding: 43 Days

The Challenge

C. F. Residential had just 50 days to close on a 142-unit value-add property in Grand Rapids. Traditional capital-raising methods stalled and approached us to assist.

The GFBS Solution

Listed the deal on our private capital network

Matched the operator with 3 actively investing family offices

Provided pitch support and direct introductions to aligned capital sources

The Results

✅ $10.1M raised in 43 days.

✅ 12 qualified investor calls booked.

✅ Oversubscribed by 9%.

✅ Closed early with better financing terms.

What the Operator Said

"GFBS unlocked capital we didn’t even know was available. Their investor network delivered fast, and the process was seamless."

— Jared, Managing Partner, C.F. Residential

✅ Want results like this?

How It Works

1. Apply for Consideration – Fill out our quick qualification form. If you meet our criteria, we’ll reach out.

2. Introductory Call – We discuss your project and ensure alignment with Family Offices in our network.

3. Curated Introductions – We set up meetings with Family Offices that match your investment profile.

4. Investor Engagement – You pitch directly to decision-makers and move forward with interested FOs.

This Isn’t for Everyone—But It Might Be for You

We only work with a limited number of operators per month to ensure high-quality introductions. If you’re serious about securing capital for your next deal, take action now.

What Happens When Capital Meets Speed

$200M+ Sourced | 12 Operators Funded | Capital in as Little as 45-90 Days.

At GFBS, we connect real estate operators with family offices — and we do it quickly. Our platform helps you raise capital fast, with precision, and from a network of exclusive, vetted investors.

Real Results You Can Trust

92% of listed deals receive investor interest within 10-14 days.

Average raise size: $16.7M

Deals funded in as little as 45 days. Results can vary.

Access to 7,700 Family offices spanning the U.S. and Canada, with a growing network in international markets.

A Proven Network of Investors

We work exclusively with a curated network of 32+ family offices, giving operators access to capital at speed without the hassle. We’ve introduced over $200M in investments since our inception.

What Our Operators Are Saying

“Jamie and his team helped us close a $14M deal in good time. The process was seamless and the investor interest was immediate.”

— Managing Director, Burkcrest Property Group

“Speed and access to capital are critical. Goodfellas delivered both and more. We can't praise them enough".

—Redwood Holdings

Ready to Get Started?